The $187 Billion Fannie-Freddie Bailout Is a Big Half-Lie

Real money talks. It says the oft-repeated meme about Fannie Mae and Freddie Mac—that they ran a, “failed model of private gains and public losses that once forced taxpayers to write a $188 billion bailout check”—is a big fat lie. If I wrote the Fact Checker column for The Washington Post, I would assign four Pinocchios to the above quote by Sens. Bob Corker and Mark Warner. The claim is indefensible because the so-called losses, which triggered the so-called bailout, were bogus. Those massive non-cash accounting provisions, booked for fiscal years 2008-2011, were reversed by the end of 2013. Absent those illusory losses, the bailout of both companies would have approximated zero. Which is why the GSE business model never, “forced taxpayers to write a bailout check.”

There is no room for debate on

this point. One can argue that the initial over-inflated provisions, booked

under the auspices of GSEs’ regulator, were fraudulent. Or one might presume

that the non-cash provisions were initially calculated in good faith and later

corrected. (Though $130+ billion in loss reversals, booked within an 18-month

timeframe in the absence of restated financials, seem highly suspicious.) But

no one, at least no one who is qualified to discuss the matter—meaning no one lacking

a good grasp of the rules of accrual accounting for financial institutions—can argue

that the initial “losses” were real. They were as illusory as the evidence of Saddam’s nuclear

weapons lab.

The private-gains/public-losses lie is deceitful in other ways. It ignores the substantial public benefits provided by the GSEs. For decades now, Fannie and Freddie have stabilized one of the world’s largest credit markets, simply because their loan performance is vastly superior to anyone else’s. (Comparative loan performance is a verboten topic among most GSE critics.) And in the wake of private market failures over the past few decades, most recently with the collapse of the private label securitization market, the GSEs liquefied the mortgage market the way no one else could.

Yet the private-gains/public-losses lie is still repeated endlessly by the Department of Treasury, by the Republican Party, and by the usual suspects affiliated with conservative think tanks. It is echoed in the Lex column of The Financial Times and, of course, on the editorial page of The Wall Street Journal.

The private-gains/public-losses lie is usually presented in the guise of opinion or analysis. Whereas the so-called $187 billion bailout of Fannie and Freddie is often cited without further clarification in the context of news reporting. This is a dangerous half-lie, which showed up recently in The Wall Street Journal, CNNMoney and The New Yorker. First, it fails to mention the spurious pretext for the initial bailout. Second, it fails to mention that the taxpayer draws were fully repaid, or that, so far, another $60+ billion in cash and equity has been drained out of the companies. I would assign this half-lie three Pinocchios.

The big half-lie about the $187 billion bailout, like the big lie about private-gains/public-losses, leaves the false impression that Fannie and Freddie operated a failed business model and/or they were mismanaged. These two deceptions are also used to attack lawsuits alleging that the government’s decision, to drain all cash and equity out of both companies in perpetuity to make sure that preferred and common shareholders never recover a nickel, was illegal.

The Washington Post editorial board is a big booster of both deceptions. The board was incensed at the idea that the companies, “could exit the regulatory control known as ’conservatorship’ that has constrained them since 2008 — and resume bundling home loans and selling them, as if it had never been necessary to bail them out to the tune of $187 billion in the first place.” The Post invoked a half-lie written by columnist Robert Samuelson, who misled readers into thinking that $241 billion in GSE profits forwarded to Treasury were disconnected from the loans booked before 2008. Those same loans ostensibly triggered $200 billion in losses during 2008-2011 and then suddenly earned $130+ billion in 2013. (You would be surprised how many economists can neither analyze a financial statement, nor understand timing differences under GAAP. And you’d be surprised how many simply repeat what they’re told, instead of figuring things out for themselves.)

Look at how Lex misled his

readers in The Financial Times a few

weeks ago. He pulled out all the stops and wrote, “In 2008, in exchange for $187bn

bailout, the Bush administration Treasury department took warrants worth 80 per

cent of the company, plus preferred stock.” Everything about sentence

demonstrates Lex’s contempt for fact checking. How was he disingenuous? Let’s

count the ways:

1.

In 2008, the Bush Treasury

Department contributed zero dollars to the GSEs. And yet, for an unfunded

commitment, plus a $2 billion “investment” that could not be used to benefit either

Fannie or Freddie, it got warrants for 79.9% of the common shares of each

company.

2.

But Lex leaves the impression that the GSEs required a

massive cash infusion, comparable to those extended to

AIG, Citigroup and Morgan Stanley. This is 100% false. He leaves the impression

that the GSEs, like the Wall Street banks, needed a bailout to shore up their

failing liquidity. Indeed, the entire financial crisis is defined by a succession

of financial crises tied to private label mortgage securitizations. Prior to

the government takeover, the GSEs had robust liquidity and unfettered access to

the debt markets. To state otherwise is to lie.

3.

The

$187 billion bailout was funded in quarterly increments beginning five months

after the GSE takeovers, when, beginning in February 2009, the companies’ new

boards declared non-cash losses that exceeded book equity. None of those $187 billion dollars was ever used to fund cash

shortfalls or operating expenses. Which is why any attempt to conflate the

bailout of Wall Street with the bailout of the GSEs is highly deceitful.

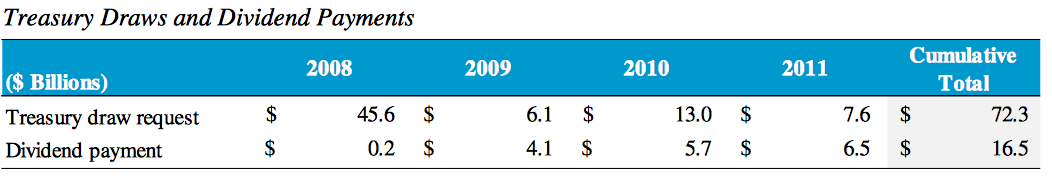

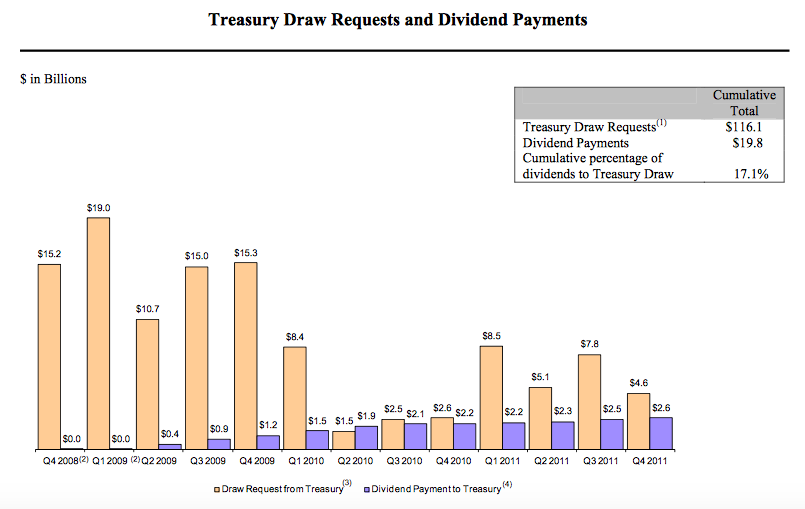

4. The word bailout can have variable meanings, but any “bailout” to fund cash dividends debases the word beyond all recognition. Once again, money (cash) talks, doublespeak walks. The GSEs didn't have retained earnings to pay cash dividends. If the GSEs had paid Treasury dividends in kind, those dividends would not have reduced equity or impaired the GSEs' solvency. But instead FHFA dictated that cash dividends shall be paid, which would reduce equity and thereby trigger an additional bailout. Treasury would send funds to the GSEs, the GSEs would then send funds back to Treasury. The net result would be that the GSEs’ cash and equity position would be unchanged and Treasury’s cash position would be unchanged. But the GSEs were "bailed out" to the tune of $36 billion for the solitary purpose of financing cash dividends that never should have been paid in the first place. (See Freddie's and Fannie's draw requests below.) In other words, if you're going to be honest, the GSE bailout was never more than $151 billion.

16 comments - The $187 Billion Fannie-Freddie Bailout Is a Big Half-Lie

Amazingly many Judges have conveniently buried their heads in the sand and have failed in their basic duty to protect the integrity of the Constitution.

Equally amazingly is that, the attorneys for shareholders did not challenge constitutionality of HERA despite direct hints by Judge Lamberth. It is no surprise that, many recent court rulings in unrelated cases may ultimately help FnF shareholders.

Or put anyother way, it would be really bad if just some PPL involved(mainly shareholders) would know but noone else would.

50 & 60 year old homeowners shouldn’t have 30-year mortgages with large balances they are continuing to pay.

Privatization would bring about a lower-leveraged, more stable, and affordable housing market that builds long-term wealth and meaningful inheritance for children by reducing the availability of Gov’t influenced, high-leverage, 30-year fixed mortgages in favor 10 to 20 year terms offered by traditional institutions.

The era of house price gains at all costs leads to bubbles. And right now, core markets nationwide are in just as big and dangerous of a housing bubble as in 2007.

By the way, on the non accounting losses to which refer, weren;t they reversed by bringing back mark to myth account and by house prices surging on trillions in Govt debt, Fed ZIRP and money printing? What if house prices hadn't have responded favorably?

Just my 2c.

Good article by the way.

You have raised more ideological and subjective questions than pragmatic ones.

There are no definitive answers to ideological and subjective questions.

Here the issues that are causing fundamental problems are:

1. Integrity of Constitution, rule of law, principles of checks and balances, Bill of rights, rights to due process, open and transparent Governance ...

2. Crony conservatorship based on rule of man than rule of law.

Proxy conservator governing based on rule of man.

3. Conflict of interest and intermingling private and public interests.

(1) Fannie & Freddie model is well proven and extremely cost efficient. It ensure liquidity at extremely low cost to millions of US households for decades.

(2) Fannie & Freddie did not cause the housing crisis. Main cause is TBTF banks dumping bad mortgage loans (with default rate as high as 35%) to Fannie & Freddie.

So you are saying 50-60 year olds should not own a home since they may not be around when it is paid off? Or their children may not inherit as much money?That is about as nonsensical statement as I have heard in a while. There are plenty of reasons older people might WANT to have a mortgage. Who are you to say what is best for them??

Have you ever done any math on the subject?

If the 30 year mortgage distorts anything, it is in a beneficial direction.

Simple math. 200k loan x15 years at 4.75% is 1556 month. - your large institution scenario.

200k x30 years at 3.75% is 926 per month. So $630 a month less. - F&F That makes the difference between renting and buying to a lot of people, including 50-60 year olds!! There are plenty of people out there you wouldn't have a home ecept for Fannie and Freddie, and not because of rates, LTV, etc. Simply the banks would gouge every American out of every last dime if they could. Plus F&F are the liquidity behind the large banks. Where do you think they sell their loans? The F&F - at least the good loans. They bad ones they sell to suckers.

No one ever says that extra payments cannot be made, hence building equity faster, but saving a percent of interest is quite appealing.

Leverage? It was your "large financial institutions" that were the ones selling highly leveraged loans!!!

What "era of house price gains leads to bubbles" are you referring? It happened once and it was not because of Fannie and Freddie. It was the "large institutions" you hold so dear. It was not the F&F loans which defaulted at astronomical rates.

All this has been proven. If you are not going to do the research then don't go spouting off what you know nothing about!!

Which bank do you work for?????

A well meaning but misguided comment above is evidence why we need as much of this out there as possible.

As for your reply...

TRAVIS 1: "So you are saying 50-60 year olds should not own a home since they may not be around when it is paid off? Or their children may not inherit as much money? That is about as nonsensical statement as I have heard in a while. There are plenty of reasons older people might WANT to have a mortgage. Who are you to say what is best for them??"

MARK REPLY 1: I never said they shouldn't "own a home". Just the opposite. My point is, at 60, with a 30 year mortgage 10 years into it, they don't "own" their home. The bank does. They will be making interest, taxes, insurance, repairs, and maintenance payments during their golden years, when most would probably rather be spending on other things but shelter. When they finally own it, it will be time to move into the rental retirement community anyway. And what is it about the American dream of "owning a home"? In fact, older American's -- empty-nesters for ex -- in droves are opting for selling houses in the burbs and renting in major metros. My inlaws OWN THEIR HOME. They bought it 35 years ago with a 15 year mortgage. Paid it off 20 years ago. And have banked countless hundreds of thousands of dollars in interest payments they put into investments and made millions from it.

TRAVIS 2: "Have you ever done any math on the subject? If the 30 year mortgage distorts anything, it is in a beneficial direction. Simple math. 200k loan x15 years at 4.75% is 1556 month. - your large institution scenario. 200k x30 years at 3.75% is 926 per month. So $630 a month less. - F&F That makes the difference between renting and buying to a lot of people, including 50-60 year olds!!"

MARK REPLY 2: Your argument is that Fannie and Freddie with their cheap 30-year mortgages allows people to buy more house than they otherwise would be able to with shorter term loans. I SAY THAT'S THE PROBLEM.

PLUS, YOUR MATH IS FAR TOO SIMPLISTIC. Longer-term loans and artificially low interest rates distort affordability allowing people to buy more than they can afford. Even with the new, more "sane" DTI levels of ~43%, income to house price are historically levered. That works great if house prices always go up. But, what if they don't. Oh, you are probably one of those status-quo headline readers that believe the housing crash was a one-off. It's not all about THE MONTHLY PAYMENT Travis. The mortgage market in 2007-10 and subprime auto sector today have learned that the painful way. Lastly, most homeowners don't have thousands a month in retirement or pensions coming in. They live modestly with a big chunck of their income from social security.

Lastly, your example of $926/mo is false (even so it's cost prohibitive for the average retiree). YOU FORGOT, prop taxes, insurance, maintenance, repairs, improvements, utilities etc making your $926/mo easily $1600/mo...BEFORE INCOME TAXES. Add on other debt such as auto, auto insurance, credit card, meals, entertainment etc etc and suddenly the $1600 becomes $3000/mo BEFORE INCOME TAXES. So, that 60 year old has to earn $50k a year gross just to pay off their monthly debt.

IF they had no mortgage their monthly nut would be reduced by $926 at least. Perhaps they could get a reverse mortgage putting $1000/mo in their pocket!

TRAVIS 3) "There are plenty of people out there you wouldn't have a home ecept for Fannie and Freddie, and not because of rates, LTV, etc. Simply the banks would gouge every American out of every last dime if they could. Plus F&F are the liquidity behind the large banks. Where do you think they sell their loans? The F&F - at least the good loans. They bad ones they sell to suckers."

MARK REPLY 3) I am not arguing whether or not Fannie or Freddie are great financing sources, they are. They offer socialized lending where the Govt pushes down rates and the tax payers are on the hook for losses. It's fantastic if you can use the system. I am arguing that the standard 30-year mortgages is great for the banks, home builders, realtors, lenders, brokers, and everybody else that sells shit to home buyers. But, it's not great for the homeowner, especially if they really want to OWN THEIR HOME, build equity, and create long-term wealth. All you have to do Travis is run side-by-side amort tables in 120, 180 and 360 month loans. The math is the math.

Your argument is that Fannie and Freddie with their cheap 30-year mortgages allows people to buy more house than they otherwise would be able to with shorter term loans. I SAY THAT'S THE PROBLEM.

TRAVIS 4) "No one ever says that extra payments cannot be made, hence building equity faster, but saving a percent of interest is quite appealing."

MARK REPLY 4) Ah, I see. You are a west or east coaster living in a bubble thinking most people out there getting $175,000, zero to 5% down loans, have EXTRA MONEY hidden away. WHAT ARE YOU SMOKING MAN. I want some.

TRAVIS 5) "What "era of house price gains leads to bubbles" are you referring? It happened once and it was not because of Fannie and Freddie. It was the "large institutions" you hold so dear. It was not the F&F loans which defaulted at astronomical rates."

MARK 5 REPLY) I fully agree the GSE's were not the problem for the great crash. But, now, because of unorthodox Govt. Fed, foreign, insti etc captial that has pushed rates to "historical lows", eased credit guidelines where Fannie, Freddie and FHA loans are easier to qualify for than in 2006, that found it's way to housing once again turning it into a bond replacement trade et al, HOUSE PRICES ARE ABOVE 2007 LEVELS in over half of the top 20 case shiller regions. It's called an ECHO-BUBBLE Travis. And it will pop too. House prices have to decline at least 25%, nationally, to make then affordable on a localized, fundamental bases, based on income, debt, and interest rate trajectories.

TRAVIS 6) "All this has been proven. If you are not going to do the research then don't go spouting off what you know nothing about!! Which bank do you work for?????"

MARK REPLY 6) NONE of what you say is proven Travis. You are totting the status quo line. YOU SOUND EXACTLY LIKE EVERYBODY IN 2006 about a potential bubble and crash.

You got this one wrong, pal,

That goes a long way in cementing as fact that it was falsified accounting that was used to put Fannie and Freddie in the conservatorship, is important and should be included in all articles about the conservatorship.

Yes, Hank Paulson's doublespeak has contributed to a lot of confusion about the pretext for conservatorship.

Here's a very brief explainer of what happened: Under the statute, FHFA could not cite insolvency or undercapitalization as grounds for an immediate government takeover (the process would take 45+ days, during which the GSEs would negotiate terms for a Treasury investment.) None of the other grounds under the statute applied.

The only possible ground was that the GSEs were "operating in an unsafe and unsound manner," which sounds like a platitude to most people but has a very specific meaning to a federal regulator, who knows that the words refer to the CAMELS risk methodology used by all federal financial regulators. CAMELS is like a combination of GAAP and credit ratings. If a financial company is unsafe or unsound, it has a CAMELS 5 rating (its about to collapse) or possibly a 4.

In April 2008 the GSEs both had 3 ratings (adequate but needs improvement) but James Lockhart secretly had his people write up fraudulent examination reports giving both GSEs 5 ratings, which gave him a pretext for taking over both companies. In public he said the GSEs had "safety and soundness issues," which is a distortion of the law. Think of it this way: everyone has mental health issues, but not everyone is mentally ill.

It was only after FHFA took over that it could impose over-inflated loss provisions on the books. This is why they needed to remove all directors and senior executives with the takeover. I’ve heard from numerous sources, there are dozens of current and former GSE professionals who are happy to spill the beans on the accounting fraud directed by FHFA after the takeovers. They are just hoping someone will subpoena them. This is all beyond the scope of the 3rd amendment litigation by the way.

IN a Class Action Lawsuit currently (April 12, 2018) ???

I have been years reading your articles. Thank you so much for standing for what is truth

and not giving in even when everybody was supporting the big lie!